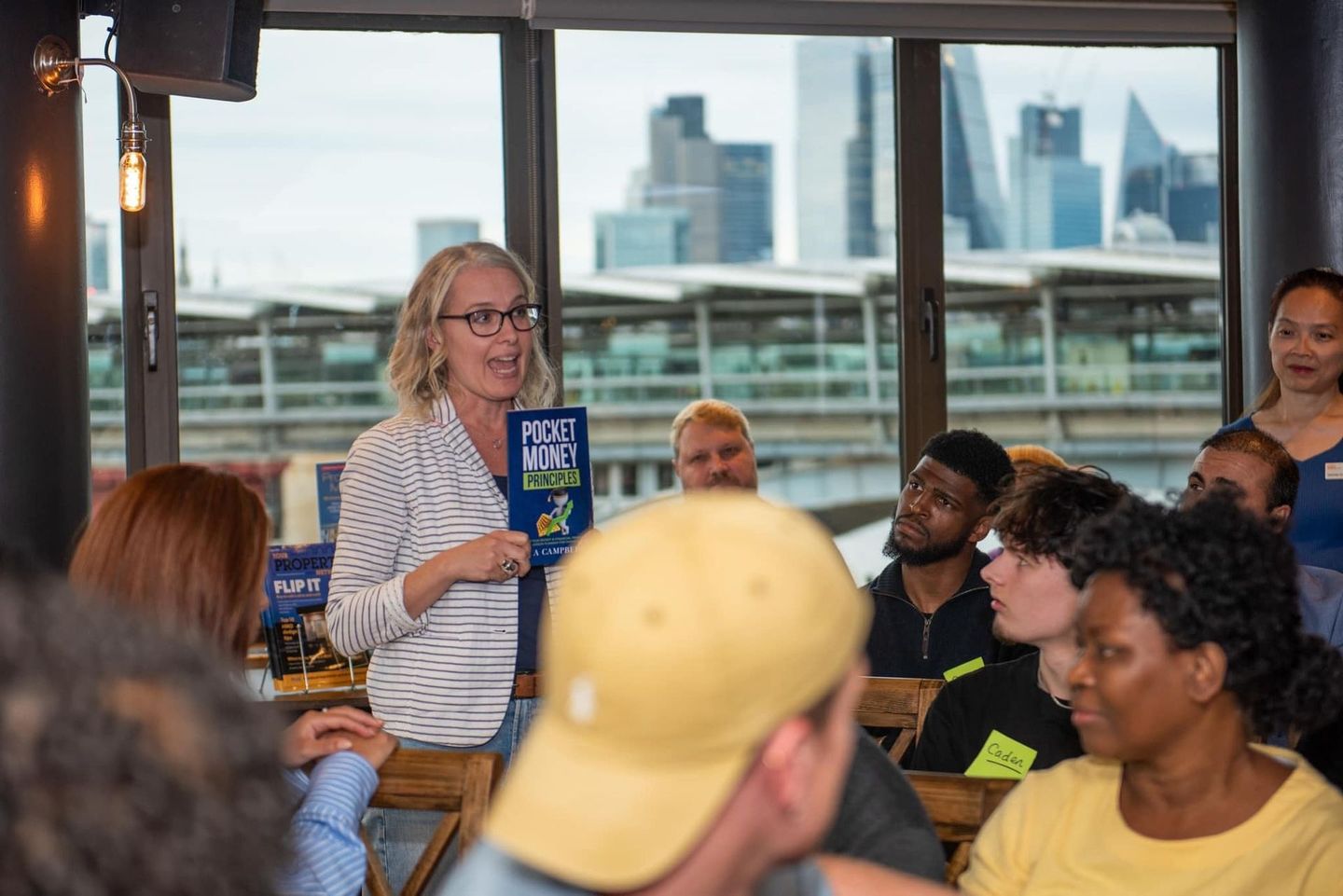

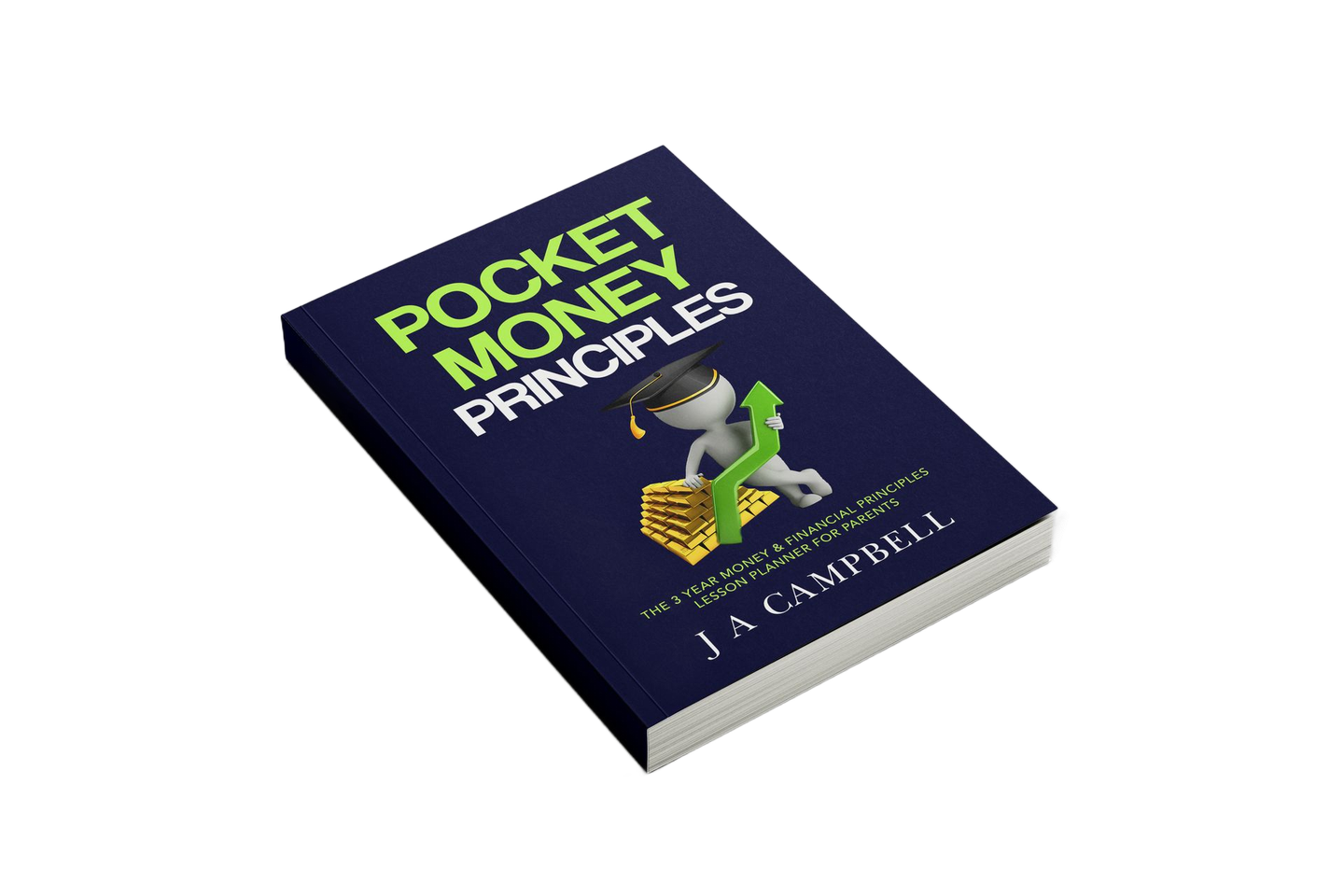

PERSONAL 1:1 FINANCIAL COACHING

Frequently asked Questions

Do you believe in Dreams or Goals ?

The difference between dreams and goals is simply planning.

Having a clear measured step by step process accompanied by time frames that makes the path ahead clear. Of course what matters most is the courage, understanding and knowing how to practically implement these step by step plans.

We work to provide simple, clear and effective solutions to your personal Financial challenges and concerns. All of our services are tailored to meet your individual needs when it comes to personal finance. We strive to provide a fantastic service for our customers to through understanding, motivation and determination, succeed and grow financially achieving their full financial and financial well being.

Our 5 principals are uncompromising, that's the reason we succeed.

We work to provide simple, clear and effective solutions to your personal Financial challenges and concerns. All of our services are tailored to meet your individual needs when it comes to personal finance. We strive to provide a fantastic service for our customers to through understanding, motivation and determination, succeed and grow financially achieving their full financial potential.